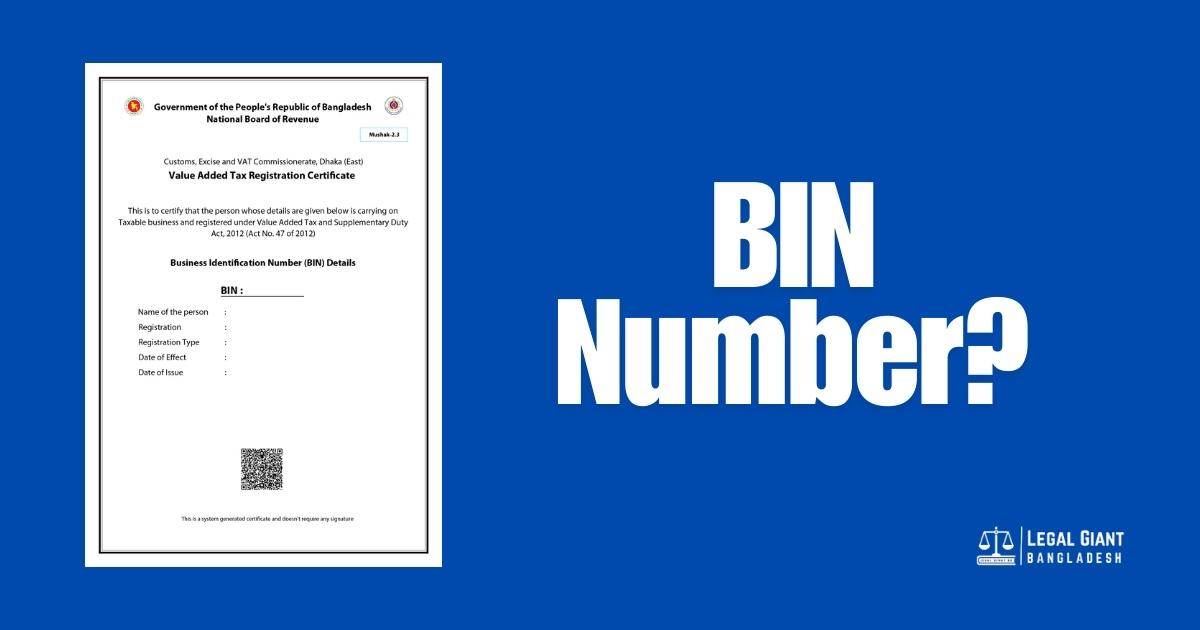

A Business Identification Number (BIN) is a unique 9-digit identifier issued by the National Board of Revenue (NBR) in Bangladesh. It is essential for businesses dealing with taxable goods and services and facilitates compliance with VAT laws.

Managed by the National Board of Revenue (NBR), the BIN registration process is now fully digitized. This guide walks you through everything you need to know, from prerequisites to successful registration.

Why BIN Registration Matters for Businesses

BIN registration is crucial for legal operations, enabling businesses to collect and pay VAT, participate in public tenders, and enhance credibility in the market.

What is BIN Registration?

A Business Identification Number (BIN) is a unique number provided by Bangladesh’s National Board of Revenue (NBR) for businesses liable to VAT. It ensures compliance with tax laws, facilitates VAT collection, and is mandatory for businesses engaging in taxable activities. The registration process can be completed offline or online through the NBR’s VAT e-Services portal. Proper documentation is essential for approval. BIN registration is crucial for legal business operations and accessing government contracts.

Definition and Purpose of BIN Registration

BIN registration is a legal requirement for businesses under the VAT Act. It ensures that businesses are accounted for in the tax system and aids the government in revenue collection.

Who Needs BIN Registration?

- Businesses with an annual turnover exceeding BDT 3 million.

- Importers, exporters, and manufacturers of taxable goods.

- Service providers offering VAT-applicable services.

Why is BIN Registration Essential?

- Legal Compliance: Mandatory for VAT purposes.

- Facilitating Business Transactions: BIN is required for issuing VAT challans, VAT returns, and tax invoices.

- Participation in Government Tenders: Most public tenders require a valid BIN certificate.

- Avoiding Penalties: Non-registration can lead to fines and legal consequences.

Documents Required for BIN Registration

To apply for BIN registration, ensure you have the following:

- Valid NID or Passport of the business owner.

- Updated Trade License.

- TIN (Taxpayer Identification Number) certificate.

- Company incorporation certificate (for limited companies).

- Bank account details.

- Proof of business location (rental agreement or ownership document).

Additional Tips:

- Double-check document accuracy to avoid delays.

- Sole proprietorships require simpler documentation compared to limited companies.

How to Get a BIN Number?

There are two ways to get a BIN number. Offline registration and online registration, you can choose any of them to complete the registration process.

Offline Registration

- Visit your nearest VAT or Tax Circle Office.

- Collect and fill out the BIN registration form.

- Submit the required documents along with the form.

- The office will verify your information, and the BIN certificate will be issued.

Steps to Apply for a BIN in Bangladesh

Steps these guides to apply for BIN number.

Step 1: Determine the Need for a BIN

Before starting the application, verify if your business requires a BIN. Businesses that engage in taxable activities or handle VAT-related goods and services must register.

Step 2: Prepare Required Documents

Having the right documents ready is critical for a seamless registration process. Here’s what you need:

- Trade License: Your business must be legally registered with a valid trade license.

- National ID (NID) or Passport: Identification of the business owner or directors.

- Taxpayer Identification Number (TIN): A valid TIN certificate.

- Bank Account Details: Information about your business bank account.

- Business Address Proof: Utility bill or rental agreement to validate the address.

- Contact Information: An active email address and phone number.

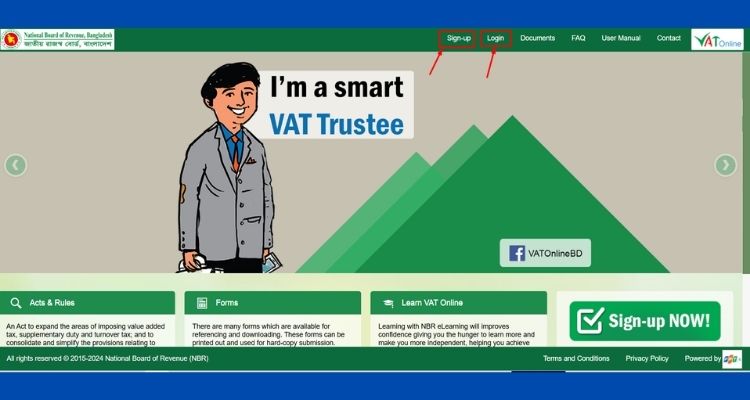

Step 3: Create an Account on the VAT Online Portal

Go to the official NBR VAT Online System at vat.gov.bd. Use your email and phone number to set up an account.

- Verify your email and phone during the account creation process.

- Ensure that you keep your login credentials secure for future access.

Step 4: Fill Out the Application Form

Once logged in, complete the application form with accurate information about your business. This includes:

- Business name and address

- Ownership type (e.g., sole proprietorship, partnership)

- Nature of business activities

Step 5: Verify and Submit Your Application

Review the details carefully before submission. Double-check critical fields like TIN, trade license number, and business address. Errors in these fields may cause delays or rejections.

Step 6: Receive Your BIN Certificate

After successful verification, the NBR will issue your BIN certificate electronically. You can download and print it from the VAT Online portal.

Important Notes for BIN Registration

- Free of Charge: BIN registration through the NBR is completely free. Avoid third-party service providers charging unnecessary fees.

- Trade License is Mandatory: Ensure your business has a valid trade license, as it is a prerequisite for BIN registration.

- Compliance with VAT Regulations: Once registered, you must adhere to VAT filing requirements and maintain proper records to avoid penalties.

Processing Time: The BIN certificate is typically issued within a few business days.

Common Challenges in BIN Registration

There are few challenges you might face during this process, these are:

Challenge 1: Incorrect or Incomplete Information

- Solution: Double-check all entries and ensure that documents match your application details.

Challenge 2: Missing Documents

- Solution: Prepare all required documents beforehand and keep scanned copies ready for upload.

Challenge 3: Technical Issues with the Portal

- Solution: Use updated web browsers and check your internet connection. Contact the NBR help desk if problems persist.

Maintaining and Renewing BIN

Businesses with a Business Identification Number (BIN) must ensure compliance by filing VAT returns regularly and keeping their registration details up-to-date with the National Board of Revenue (NBR). Changes in business information, such as address or ownership, should be reported immediately. While BIN certificates typically do not need renewal, failing to adhere to VAT filing requirements can result in penalties or suspension. Proper maintenance helps avoid disruptions in business operations and ensures continued legal compliance.

Updating BIN Details

If your business undergoes changes (e.g., relocation, ownership change), you must update your BIN information via the VAT portal or local tax office.

Renewal Process

Although BIN certificates do not require yearly renewal, businesses must file VAT returns regularly to maintain validity.

Penalties: Late VAT filing or non-compliance with BIN regulations can result in fines and legal actions.

Frequently Asked Questions

Read the FAQs about BIN registration.

What is a BIN, and Why Is It Necessary?

A Business Identification Number (BIN) is required for businesses engaging in taxable goods or services in Bangladesh. It ensures legal compliance with VAT regulations.

How Can I Apply for A Bin?

You can apply online via the NBR VAT e-Services portal or offline at your local VAT office.

Is BIN Registration Free?

Yes, Bin Registration Is Free of Cost.

Can I Update My BIN Details Later?

Yes, You Can Update Your Details by Notifying the Nbr.

Do BIN Certificates Expire?

Bi Ns Do Not Expire but Require Regular Vat Return Filings to Stay Valid.

Conclusion

BIN registration is a cornerstone of business compliance in Bangladesh. It ensures smooth operations, supports legal accountability, and enhances a company’s reputation. By following the outlined steps and adhering to regulations, you can secure your BIN certificate and contribute to a transparent and efficient tax system.