Filing income tax returns is a vital responsibility for citizens, regardless of income level. For individuals with no taxable income, submitting zero income tax returns demonstrates compliance with national regulations and maintains an active tax record. This guide explains the process of filing zero income tax returns online in Bangladesh, providing practical, step-by-step instructions and addressing common concerns.

Whether you’re a student, homemaker, or retiree, understanding how to complete this process ensures you remain on the right side of the law and gain access to benefits such as financial documentation for loans or visas.

Overview of Tax Filing in Bangladesh

Tax filing is an essential civic responsibility that ensures compliance with Bangladesh’s tax regulations. It plays a critical role in the nation’s economic framework by supporting public infrastructure, development projects, and government services. Here’s a detailed overview of the tax filing process and its significance in Bangladesh:

Legal Framework

The National Board of Revenue (NBR) governs income tax regulations in Bangladesh. Every individual earning above the tax-exempt threshold must file a tax return. Even individuals without taxable income are encouraged to file, demonstrating a commitment to compliance and creating an official tax record.

Who Must File Tax Returns?

Tax filing applies to various categories of individuals and entities:

- Individuals with Taxable Income: Those earning above the exempt threshold (currently set at BDT 300,000 for general taxpayers, with higher thresholds for senior citizens and other specific groups).

- Individuals with Zero Taxable Income: Filing is optional but recommended to maintain an active tax file.

- Companies and Organizations: Businesses must file corporate tax returns based on their income and operations.

Benefits of Tax Filing

- Legal Compliance: Filing ensures adherence to the laws and prevents penalties for non-compliance.

- Access to Financial Services: A valid tax record is often required for loans, credit cards, or visa applications.

- Avoidance of Penalties: Late or non-filing can result in fines or legal complications.

- Participation in Nation-Building: Contributing to the tax system supports national development and governance.

Key Features of Bangladesh’s Tax Filing System

- Taxpayer Identification Number (TIN):

- A TIN is mandatory for all taxpayers, serving as a unique identifier in the tax system.

- Individuals must obtain their TIN from the NBR before filing returns.

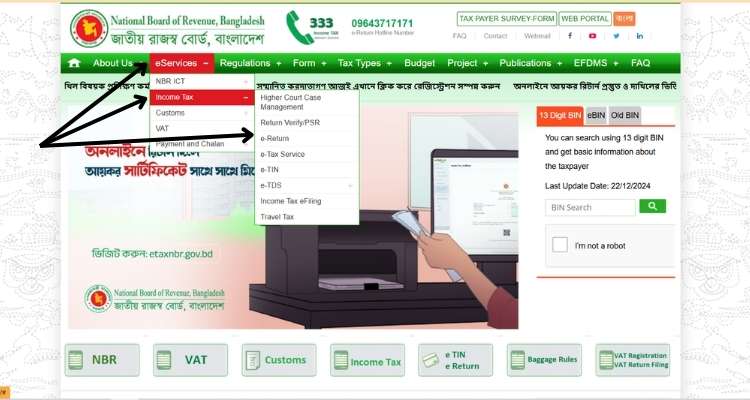

- Online Tax Filing Portal:

- The NBR’s online filing platform simplifies the submission process.

- Taxpayers can log in, complete their forms, and submit returns digitally.

- Tax Exemptions and Deductions:

- Certain incomes, such as agricultural earnings or small business profits below a threshold, may be exempt.

- Deductions for investments, donations, and other approved expenses reduce taxable income.

Challenges in Tax Filing

While Bangladesh has made strides in digitalizing the tax filing process, challenges remain:

- Low Awareness: Many citizens are unaware of their obligations or the benefits of filing returns.

- Technical Barriers: Limited access to technology can hinder online filing, especially in rural areas.

- Complex Regulations: Understanding exemptions, thresholds, and forms can be daunting for first-time filers.

Filing income tax returns, whether for taxable or zero income, is an essential practice for financial and legal security in Bangladesh. By staying informed and compliant, citizens can not only avoid penalties but also contribute positively to the country’s economic growth.

Prerequisites for Filing Zero Returns

Filing zero income tax returns in Bangladesh is a straightforward process, but preparation is essential to ensure smooth and error-free submission. Here’s a detailed look at what you need to know and gather before starting:

Eligibility Criteria

You must file zero income tax returns if:

- You have no taxable income but want to maintain a tax record.

- You are a citizen above the age of 18 with a TIN (Taxpayer Identification Number).

Exceptions include individuals who:

- Earn below the minimum income threshold and fall into exempted categories like certain agricultural workers.

- Do not own property or assets that require tax declaration.

Required Documentation

Before you begin, ensure you have:

- National Identification Number (NID): Required for identity verification.

- Taxpayer Identification Number (TIN): An active TIN is mandatory to file any tax return.

- Access to the NBR Portal: Ensure you can log in or create an account on the NBR’s online filing system.

- Additional Documentation: For some individuals, such as business owners, proof of zero income may be required.

Step-by-Step Guide to Filing Zero Income Tax Returns Online

Filing zero returns through the NBR portal is a straightforward process. Here’s a step-by-step guide:

Step 1: Accessing the Online Portal

- Open your web browser and visit the NBR portal.

- Create an account if you’re a new user. You’ll need your NID and TIN to register.

- Log in using your credentials.

Step 2: Navigating the Portal

- Once logged in, select the “File Tax Return” option on the dashboard.

- Choose the option for zero income tax returns. This is specifically designed for individuals with no taxable income.

Step 3: Inputting Details

- Enter your personal information, including your TIN and NID.

- Input your income details. For zero returns, state that you had no taxable income during the financial year.

- Verify all data before proceeding. Errors at this stage can delay the process.

Step 4: Submitting the Return

- Review the return form to ensure all details are accurate.

- Submit the form electronically.

- Download the acknowledgment receipt as proof of submission.

Common Challenges and How to Overcome Them

There are many challenges to give zero return online like technical, documents and clothes. You can solve these issues by yourself;

Technical Issues

- Problem: The online portal may experience downtimes or errors during peak filing periods.

- Solution: File early to avoid last-minute issues. Keep NBR’s helpdesk contact details handy for troubleshooting.

Misunderstanding Requirements

- Problem: Misinterpreting eligibility criteria can lead to confusion.

- Solution: Refer to the NBR guidelines or consult a tax advisor for clarity.

Documentation Errors

- Problem: Mistakes in TIN or NID details can cause rejection of your return.

- Solution: Double-check all information before submission.

Tips for Hassle-Free Filing

- Organize Documents in Advance: Having your NID and TIN ready ensures a smooth process.

- File Early: Avoid last-minute submissions to prevent server issues or errors.

- Double-Check Details: Carefully review all information to reduce rejection risk.

- Seek Help When Needed: Use NBR’s helpdesk or consult a professional for technical or procedural assistance.

FAQs on Filing Zero Income Tax Returns in Bangladesh

Do I need to file if I have no taxable income?

Yes. Filing zero returns maintains an active tax record and ensures compliance.

What happens if I don’t file zero returns?

Failure to file can result in penalties or disqualification from benefits such as loan applications.

Can I file manually instead of online?

While online filing is encouraged, manual submission is an option for those without internet access. Visit your nearest tax office for assistance.

Is there a penalty for late filing?

Yes, penalties may apply for missing deadlines, even for zero returns. Filing early helps avoid this.

How often do I need to file?

Tax returns, including zero income returns, must be filed annually.

Conclusion

Filing zero income tax returns online in Bangladesh is a simple yet crucial step in fulfilling your civic duties. It helps maintain compliance with tax regulations, ensures access to financial benefits, and contributes to a transparent economy. By following this guide, you can complete the process with ease and confidence.

Whether you’re filing for the first time or looking to ensure accuracy, this step-by-step approach demystifies the process and makes it accessible to all. Take the first step today by logging into the NBR portal and staying compliant for the future.