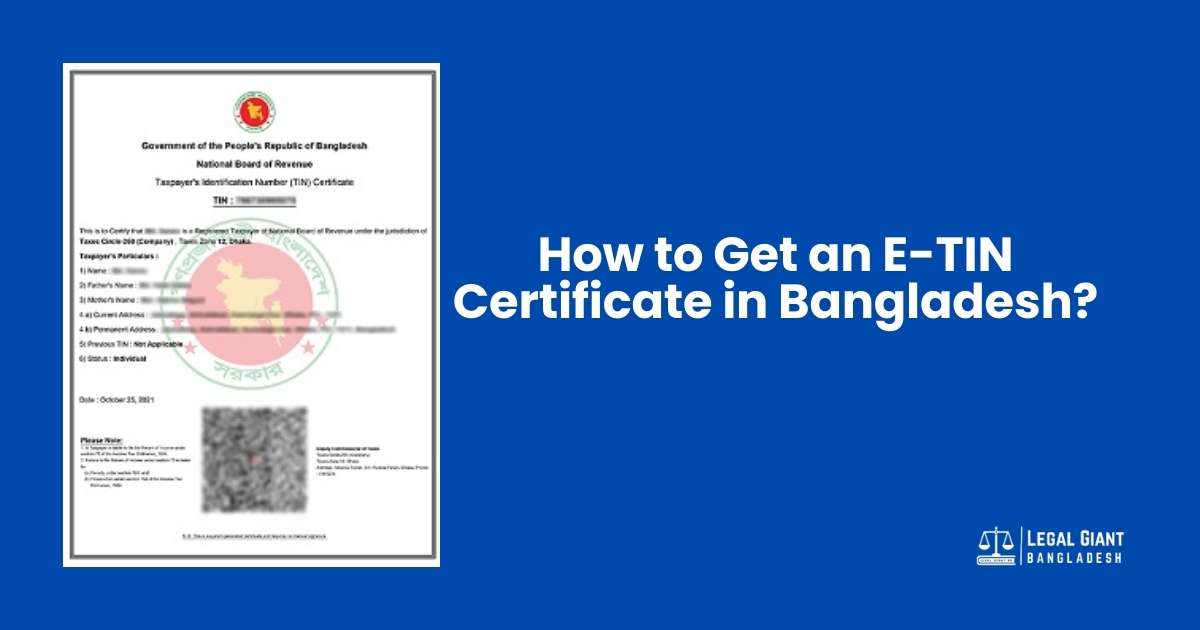

An Electronic Taxpayer Identification Number (E-TIN) is a vital document in Bangladesh for individuals and businesses. It is a unique number assigned to taxpayers by the National Board of Revenue (NBR) and is required for a wide range of financial transactions, including opening a bank account, applying for loans, participating in tenders, and filing income tax returns.

In this comprehensive guide, we will explain everything you need to know about obtaining an E-TIN certificate in Bangladesh, including eligibility, prerequisites, step-by-step instructions, and answers to frequently asked questions.

What is an E-TIN Certificate?

The E-TIN certificate is a document issued by the National Board of Revenue (NBR), the central tax authority in Bangladesh. It provides a taxpayer with a unique identification number that facilitates tax-related activities. The certificate is issued electronically, streamlining the process for both the applicant and the government.

Why is it Important?

The E-TIN certificate is essential for ensuring compliance with Bangladesh’s tax regulations. It is a requirement for:

- Filing annual income tax returns

- Accessing government services

- Opening corporate and individual bank accounts

- Engaging in trade and business activities

- Buying or selling property

Having an E-TIN also signals good financial standing and transparency.

Eligibility for an E-TIN Certificate: Who Can Apply?

Any Bangladeshi citizen or legal entity engaged in income-generating activities can apply for an E-TIN certificate. This includes:

- Salaried Individuals: Professionals working in public or private sectors.

- Business Owners: Entrepreneurs or businesses generating taxable income.

- Freelancers and Online Workers: Those earning income from international or local clients.

- Foreign Investors and Entities: Companies or individuals conducting business in Bangladesh.

Types of Applicants

- Individual: Any citizen earning an income that falls under the taxable threshold.

- Corporate Entity: Companies registered under the Companies Act of 1994 or any other legal framework.

- Non-Resident Bangladeshi (NRB): NRBs who maintain taxable activities in the country.

Prerequisites for Applying

Required Documents

For a seamless application process, gather the following documents:

For Individuals

- National ID card (NID) or passport

- Proof of residence (utility bills or rental agreement)

- Mobile phone number

- Email address

For Businesses

- Trade license or business registration certificate

- Company TIN registration details (if applicable)

- Company seal or stamp

- National ID or passport of the proprietor or directors

- Bank account details

Information Needed

In addition to the documents, applicants should prepare the following information:

- Personal details (name, father’s name, mother’s name, date of birth)

- Nature of business (for business applications)

- Estimated annual income

- Tax zone or circle applicable to your location

Step-by-Step Guide to Obtain an E-TIN Certificate 2025

For Individuals

- Visit the NBR Website

Go to the official NBR e-Services Portal: www.incometax.gov.bd. - Register as a User

- Click on the “Register” option.

- Provide your NID or passport number.

- Input your name, date of birth, and other personal details.

- Enter a valid mobile number and email address.

- Fill in the Application Form

- After registration, log in and select “Apply for E-TIN.”

- Complete the form with your personal and financial details.

- Upload the required documents.

- Verify and Submit

- Review the application form for accuracy.

- Submit the form and wait for confirmation.

- Receive Your E-TIN Certificate

- Upon successful verification, the E-TIN certificate will be generated electronically.

- Download and print your certificate for future use.

For Businesses

- Prepare the Necessary Documents

Gather your trade license, NID, company details, and other required information. - Access the NBR Portal

Visit the NBR e-Services portal and create an account for your business. - Fill in the Business Details

- Select the “Corporate Taxpayer” option.

- Enter details like the trade license number, type of business, and address.

- Upload Supporting Documents

Upload scanned copies of your trade license, NID, and other relevant documents. - Submit the Application

- Double-check the form before submission.

- Submit the application and wait for verification.

- Receive the E-TIN Certificate

Once approved, the business E-TIN certificate will be available for download.

Also Read: How to Get a BIN Number in Bangladesh?

Common Uses of an E-TIN Certificate

The E-TIN certificate is required in various scenarios, including:

Financial Transactions

- Opening Bank Accounts: Many banks mandate an E-TIN for corporate and high-value individual accounts.

- Property Transactions: Buying, selling, or registering property often requires an E-TIN.

- Vehicle Registration: The purchase and registration of vehicles demand this document.

Government Services

- Tax Filing: An E-TIN is mandatory for filing annual income tax returns.

- Participating in Tenders: Government tenders and contracts require bidders to provide a valid E-TIN.

- Loans and Credits: Financial institutions may request an E-TIN for processing loan applications.

FAQs About E-TIN in Bangladesh

How Do I Update My E-TIN Information?

You can log in to the NBR portal and update your information under the “Profile Update” section. Ensure that all changes are documented, such as address or contact number updates.

Is Renewal Required for an E-TIN?

No, E-TINs do not require renewal. However, you must ensure your information remains accurate and up-to-date.

What Happens if I Don’t Have an E-TIN?

Not having an E-TIN can result in legal penalties if you engage in taxable activities. Additionally, you may face restrictions on financial transactions.

Do Freelancers Need an E-TIN?

Yes, freelancers earning taxable income from local or international sources are required to obtain an E-TIN.

Conclusion and Tips

Obtaining an E-TIN certificate in Bangladesh is a straightforward process thanks to the NBR’s digitization efforts. By following the steps outlined in this guide, you can easily secure your certificate and stay compliant with tax regulations.

Tips for Success

- Ensure Accuracy: Double-check all information before submission to avoid delays.

- Keep Documents Handy: Maintain an organized file of your documents for future use.

- Stay Updated: Regularly check the NBR portal for updates on tax laws and compliance.

By obtaining your E-TIN, you not only fulfill your legal obligations but also enhance your credibility in financial and business dealings.